|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Current Home Refinance Rates in Texas: What to Expect in Today's MarketUnderstanding Home Refinance RatesWhen considering refinancing a home in Texas, it's crucial to understand how current refinance rates can impact your mortgage. With fluctuating market conditions, knowing the right time to refinance is essential. Factors Affecting Refinance Rates

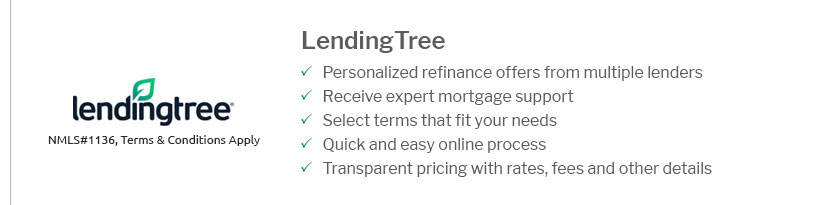

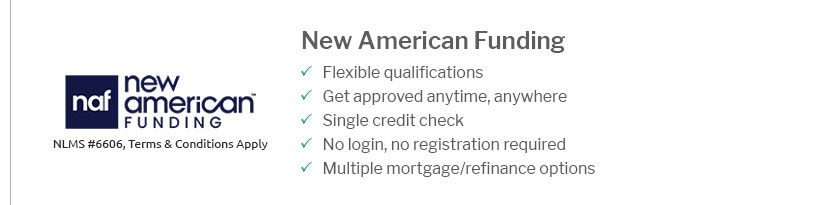

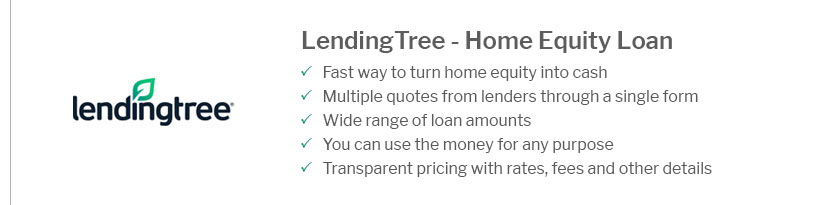

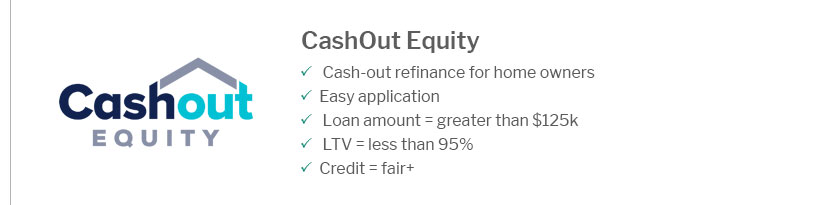

Benefits of RefinancingRefinancing can potentially lower your monthly payments, reduce your interest rate, or change your loan term. Additionally, it might help you access equity for home improvements or other expenses. Current Trends in Texas Refinance RatesAs of now, Texas refinance rates are influenced by both national and local economic factors. Homeowners should stay informed about these trends to make the best financial decisions. Comparing RatesIt's advisable to compare rates from multiple lenders. Online resources such as refinance home loan with default offer valuable insights and comparisons. Steps to Refinance Your Home

For a comprehensive guide, consider visiting refinance mortgage la gi. Frequently Asked QuestionsWhat is the average refinance rate in Texas right now?The average refinance rate in Texas varies based on several factors, including credit score and loan type. As of the latest data, rates range from 3% to 4% for a 30-year fixed loan. How can I qualify for the best refinance rates?To qualify for the best rates, maintain a high credit score, ensure a low debt-to-income ratio, and provide detailed financial documentation. Is it worth refinancing my home in Texas?Refinancing may be beneficial if it significantly lowers your interest rate, reduces your monthly payment, or shortens your loan term. Always consider closing costs and the break-even point before making a decision. https://www.totalmortgage.com/locations/state/TX/mortgage-rates

The mortgage rates in Texas are as low as 6.125% for a 30-year fixed mortgage. These rates are effective as of January 24 2025 12:30pm EST. https://www.texasunitedmortgage.com/what-are-todays-mortgage-rates-in-texas

Get your rate today! We'll give you a no-haggle, low rate quote with fast response times and friendly service. Get Your Rate Today.

|

|---|